The end of 2016 may bring with it planning for next year’s taxes. If you want to save on your tax bill and your home energy bill at the same time, you can install certain types of high-efficiency HVAC equipment that qualifies for tax credits. Here are some details on these credits and what kinds of equipment earns them.

Tax Credit Details

Federal income tax credits for energy efficiency are available for certain types of HVAC systems and construction features. The credits can be applied directly to your income taxes. The credits are available for purchases made in both 2015 and 2016. The credits expire on December 31, 2016.

Consult with your tax professional for details on limitations and applications.

Tax Credit Facts

Credits for certain HVAC systems and construction features qualify only for your principal place of residence. These credits do not apply if the equipment is purchased for a rental unit or a second home. Credits are for 10 percent of the cost of the equipment — as much as $500 — or for a specified amount between $50 and $300.

- Air source heat pumps (both split and package systems): $300 credit.

- Central air conditioning (both split and package systems): $300 credit.

- Gas, propane, or oil furnaces and fans: $150 for furnace, $50 for advanced main air circulating fan.

- Insulation (does not include installation): 10 percent of cost up to $500.

- Roofs (metal and asphalt roofs with coatings designed to reduce heat gain): 10 percent of cost.

- Windows and doors: 10 percent of cost up to $200 for windows and $500 for doors.

- Non-solar water heaters: $300 credit.

- Geothermal heat pumps: 30 percent credit, including installation.

State Tax Credits

You may also be eligible for some types of state-level tax credits or efficiency incentives. Check the Database of State Incentives for Renewables and Efficiency (DSIRE) for Oregon.

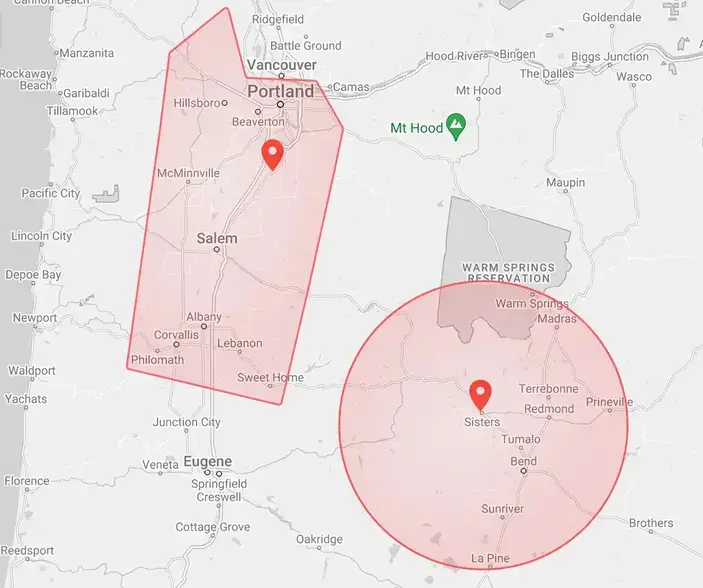

Roth Home has been a top choice for HVAC services in Portland, Hillsboro, Canby, and the surrounding Oregon communities for 40 years. Contact us today for more information on energy efficiency tax credits and for the HVAC equipment that will qualify for them.